By Rajkamal Rao

|

| Image Courtesy: U.S. Department of Education |

Section 529 of the Internal Revenue Code allows states, state agencies, and eligible educational institutions to sponsor qualified tuition programs (529 plans), which are tax-advantaged vehicles designed to encourage saving for future qualified higher education expenses and certain K-12 tuition expenses of a beneficiary.

If you're a parent, grandparent, or a relative of a student, you can become a 529 account holder. Anyone who is at least age 18, possesses a physical address in the United States and has a valid Social Security Number or Tax Identification Number can be an account owner. There are thousands of 529 plans in which you can invest. Contributions are on an after-tax basis, but any growth of the fund's value (through dividends and capital gains) is tax-free. This feature is the most attractive benefit of qualified tuition programs.

Anyone can contribute to a 529 account regardless of who owns the account, but only the account owner has control over how money is invested and used. Only the account owner is eligible for federal and state tax benefits. The maximum aggregate account balance for all 529 accounts for the same beneficiary is $485,000.

The account beneficiary is the student for whom you are investing money for their qualified higher education or K-12 tuition expenses. Any person with a physical address in the United States and a valid Social Security Number or Tax Identification Number can be a beneficiary.

Funds in the 529 plan can be used for "qualified" education expenses when the student attends an eligible educational institution. An eligible educational institution is any college, university, or vocational school in the United States or abroad qualified to participate in federal student aid programs. You can determine the eligibility of an educational institution by going to the U.S. Department of Education’s Database of Accredited Post Secondary Institutions and Programs (DAPIP) or the Federal Student Loan Program list. According to a 2023 law, up to $35,000 in funds remaining in a 529 plan can be rolled over into a Roth IRA for the student (the beneficiary). This will encourage more parents to invest in 529s knowing that they don't have to pay taxes on withdrawals after their qualified expenses have been met.

To be considered a qualified withdrawal, money must be withdrawn from an account in the same period that educational expenses are incurred. Examples of qualified education expenses:

Tax treatment of 529 withdrawals (1099-Q) - RAO ADVISORS EXAMPLE

The family withdraws the $25,598 from the 529 plan. Because this entire amount is qualified (tuition, fees, room, and board), it is 100% tax free. But the daughter has also received $13,500 as a scholarship from an endowment. This amount is taxable to the student.

During tax season, the family gets three sets of forms:

Parental tax return: Because the daughter depended upon her parents for more than 50% of her living expenses, her parents should claim her as a dependent on their tax return. The parents will enter the 1098-T form details into their Form 1040 and claim one of two tax credits (the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC)) if they meet income requirements. Tax credits reduce taxes owed dollar for dollar.

Student tax return: The student will also enter the 1098-T form to record scholarships received. Because the daughter was the beneficiary of the 529 plan disbursements, she must pay taxes on the gain if used for unqualified expenses. But all of her expenses were qualified. The 1099-Q will have the following key fields populated.

The daughter must file a tax return - as an individual - to report Box 2 earnings as income if used for unqualified expenses. But all earnings went to pay for qualified expenses - so they would cancel out for tax purposes. She should enter all of her education expenses - tuition, books [required by the university), books (not required by the university)], room and board, computers, internet, etc.

In this case, the daughter received $13,500 in a scholarship which is taxable. So this amount appears on the student's return as income. If the student had an educational loan to pay for additional expenses not allowed by the 529 plan, she would enter 1099-E details into her tax return. For this example, let us assume that she has no education loans to report.

For 2021, her tax due would be $1,123 (tax owed because of the scholarship). To avoid penalties, she should have made four equal estimated tax payments of $281, one per quarter, leading up to tax filing day - or else incur a penalty for underpayment of taxes. Most students would not think of doing this. Luckily, if this is her first year of paying income taxes and she did now owe any taxes for the previous year, 2020, the IRS allows a one-time penalty waiver.

But for subsequent years, the IRS will impose a penalty if the student does not make her regular EST payments.

A Note About Rao Advisors Premium Services

Our promise is to empower you with high-quality, ethical, and free advice via this website. But parents and students often ask us if they can engage with us for individual counseling sessions.

Individual counseling is part of the Premium Offering of Rao Advisors. Please contact us for more information.

Go back to "Rao Advisors - Home".

Funds in the 529 plan can be used for "qualified" education expenses when the student attends an eligible educational institution. An eligible educational institution is any college, university, or vocational school in the United States or abroad qualified to participate in federal student aid programs. You can determine the eligibility of an educational institution by going to the U.S. Department of Education’s Database of Accredited Post Secondary Institutions and Programs (DAPIP) or the Federal Student Loan Program list. According to a 2023 law, up to $35,000 in funds remaining in a 529 plan can be rolled over into a Roth IRA for the student (the beneficiary). This will encourage more parents to invest in 529s knowing that they don't have to pay taxes on withdrawals after their qualified expenses have been met.

To be considered a qualified withdrawal, money must be withdrawn from an account in the same period that educational expenses are incurred. Examples of qualified education expenses:

- K-12 tuition expenses of an account beneficiary who attends a public, private or religious school (up to $10,000 per calendar year per beneficiary from all qualified tuition programs).

- College tuition, mandatory fees, books, supplies, and equipment required for the beneficiary to enroll and attend an eligible higher educational institution.

- A computer, peripheral computer equipment, software, and internet access while enrolled in

an eligible higher educational institution. - Room and board, if the beneficiary is enrolled at least half time. Half-time enrollment is

defined as half of a full-time academic semester or term workload. Costs cannot exceed the allowance for room and board as determined by the eligible higher educational institution.

- Transportation expenses

- Cellphone plans

- Sports and fitness club memberships

- Health insurance

Tax treatment of 529 withdrawals (1099-Q) - RAO ADVISORS EXAMPLE

When parents contribute funds into a 529 plan, they do so on their after-tax income. That is, contributions to a 529 plan are not tax-deductible, like IRA or 401K plans. But funds already in a 529 account grow tax-free.

Suppose that parents contribute $100,000 into their daughter's 529 plan over 10 years. And over time, suppose that the fund has grown to $155,000.

The $55,000 gain in the fund is not taxable if the money is used for qualified educational expenses, such as tuition, books approved by the university as required, meals, and housing costs as determined by the university. But the funds become taxable to the daughter, the beneficiary, if funds are used for unqualified education expenses such as transportation, cellphone plans, health insurance fees, gym memberships, and extracurricular activities. The gain is NOT taxable to the parents.

The daughter begins her college journey with the parents paying more than half of her cost of attendance (tuition, fees, room and board) using the 529 plan as the funding vehicle. Suppose the daughter incurs $25,598 in tuition, fees, and room and board expenses for her first year in college. Suppose that the daughter also has a full ride from the school's endowment - that is, the daughter's tuition is paid for by an entity other than the university.

Suppose that parents contribute $100,000 into their daughter's 529 plan over 10 years. And over time, suppose that the fund has grown to $155,000.

The $55,000 gain in the fund is not taxable if the money is used for qualified educational expenses, such as tuition, books approved by the university as required, meals, and housing costs as determined by the university. But the funds become taxable to the daughter, the beneficiary, if funds are used for unqualified education expenses such as transportation, cellphone plans, health insurance fees, gym memberships, and extracurricular activities. The gain is NOT taxable to the parents.

The daughter begins her college journey with the parents paying more than half of her cost of attendance (tuition, fees, room and board) using the 529 plan as the funding vehicle. Suppose the daughter incurs $25,598 in tuition, fees, and room and board expenses for her first year in college. Suppose that the daughter also has a full ride from the school's endowment - that is, the daughter's tuition is paid for by an entity other than the university.

The family withdraws the $25,598 from the 529 plan. Because this entire amount is qualified (tuition, fees, room, and board), it is 100% tax free. But the daughter has also received $13,500 as a scholarship from an endowment. This amount is taxable to the student.

During tax season, the family gets three sets of forms:

- 1098-T (a record of all tuition payments made to the university and any scholarships or grants received);

- 1099-E (a record of the daughter's loan payments, if any, addressed to the daughter); and

- 1099-Q (a record of disbursements from the fund operating the 529 plan, addressed to the daughter).

Parental tax return: Because the daughter depended upon her parents for more than 50% of her living expenses, her parents should claim her as a dependent on their tax return. The parents will enter the 1098-T form details into their Form 1040 and claim one of two tax credits (the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC)) if they meet income requirements. Tax credits reduce taxes owed dollar for dollar.

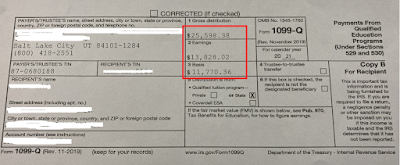

Student tax return: The student will also enter the 1098-T form to record scholarships received. Because the daughter was the beneficiary of the 529 plan disbursements, she must pay taxes on the gain if used for unqualified expenses. But all of her expenses were qualified. The 1099-Q will have the following key fields populated.

|

| 1099-Q form. Image Courtesy: Rao Advisors |

- Box 1 (Gross Distribution): $25,598

- Box 2 (Earnings): $13,828

- Box 3 (Basis): $11,770

The daughter must file a tax return - as an individual - to report Box 2 earnings as income if used for unqualified expenses. But all earnings went to pay for qualified expenses - so they would cancel out for tax purposes. She should enter all of her education expenses - tuition, books [required by the university), books (not required by the university)], room and board, computers, internet, etc.

In this case, the daughter received $13,500 in a scholarship which is taxable. So this amount appears on the student's return as income. If the student had an educational loan to pay for additional expenses not allowed by the 529 plan, she would enter 1099-E details into her tax return. For this example, let us assume that she has no education loans to report.

For 2021, her tax due would be $1,123 (tax owed because of the scholarship). To avoid penalties, she should have made four equal estimated tax payments of $281, one per quarter, leading up to tax filing day - or else incur a penalty for underpayment of taxes. Most students would not think of doing this. Luckily, if this is her first year of paying income taxes and she did now owe any taxes for the previous year, 2020, the IRS allows a one-time penalty waiver.

But for subsequent years, the IRS will impose a penalty if the student does not make her regular EST payments.

A Note About Rao Advisors Premium Services

Our promise is to empower you with high-quality, ethical, and free advice via this website. But parents and students often ask us if they can engage with us for individual counseling sessions.

Individual counseling is part of the Premium Offering of Rao Advisors. Please contact us for more information.

Go back to "Rao Advisors - Home".

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.